Zijin, Jiangxi copper, Tongling Nonferrous ls... How were the domestic mining enterprises in the first half of the year? How much did you make?

Last year, affected by the epidemic, the market demand of multiple industries declined, coupled with the impact of trade and related tax policies, the M & A of the global mining and l industries decreased significantly in the first half of 2020. In 2021, the global economy will rebound sharply, the industry will gradually return to normal, and the upgrading of infrastructure will promote the recovery of demand for iron ore and other bulk minerals. The green economy and new energy stimulus policies aimed at carbon neutrality will further promote the demand growth of rare earth, gallium, germanium, cadmium and tellurium. The epidemic will show demand for copper, silver and other mineral products related to antibacterial disinfection and improving air quality, and will promote the recovery of related mineral markets. Recently, a number of enterprises released the performance forecast for the first half of 2021. It's more than half of 2021. How are Zijin, Jiangxi copper, Tongling Nonferrous ls and other domestic enterprises going? What's the performance? How much did you make?

1ZIJIN MINING GROUP COMPANY LIMITED

Performance: at the beginning of this month, Zijin Mining announced that the company's net profit from January to June 2021 is expected to be 6.2 billion yuan to 6.6 billion yuan, an increase of 3.8-4.2 billion yuan over the same period of last year, a year-on-year increase156.09%-172.61%。

The main reason for the significant increase in performance is that in the first half of the year, due to the sharp increase of global capital liquidity and the impact of the epidemic situation, the prices of major l minerals are rising continuously, and the prices of copper, zinc and other ls have risen sharply year on year. Zijin expanded the production of main products, and the output of gold, copper and zinc of main mineral products increased year on year, becoming the main growth point of performance. In addition, Zijin Mining Group two world-class high-grade mines have been put into operation. At the end of May, the first series of the first phase of kamoa kakula copper mine officially started the production of copper concentrate, and the annual output of copper is expected to be about 200000 tons after the production. In June, the pilot production of the upper belt of chukalu peghi copper gold mine began to be pilot production, and it is expected to produce 91000 tons of copper and 2.5 tons of gold annually after putting into operation. The world-class copper dragon copper industry drive project in Tibet is also entering a critical stage, and is planned to be completed and put into operation by the end of this year. Zijin has a strong performance this year, which is expected.

2jiangxi copper corporation limteo

Performance: according to the half year performance forecast released at the beginning of this month, it is estimated that the net profit attributable to shareholders of listed companies will be 2.990-3.214 billion yuan from January to June 2021, which will increase by 2.245-2.469 billion yuan compared with the same period of last year, with a year-on-year increase301%-331%。

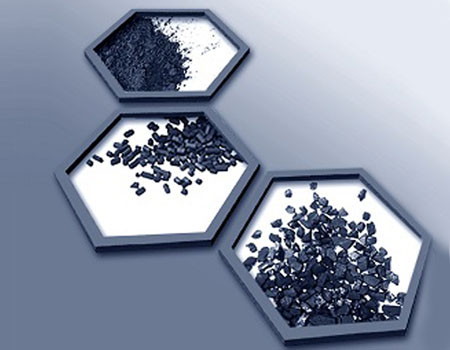

Jiangxi Copper's main business covers copper and gold mining, smelting and processing;

Extraction and processing of scattered ls; Sulfur chemical industry, finance and trade, etc. In the field of copper and related non-ferrous ls, a complete industrial chain integrating exploration, mining, beneficiation, smelting and processing has been established. As for the main reason for the doubling of performance, the announcement shows that the year-on-year sharp rise in the prices of copper, sulfuric acid and other main products is the main driving force for performance growth.

3SHANXI COKING COAL GROUP CO.,LTD.

Performance: according to the half year performance forecast of 2021, the net profit attributable to shareholders of Listed Companies in the first half of 2021 is expected to be 1.815-2.057 billion yuan, which is expected to increase compared with the same period of last year50%-70%。

The reasons for the performance growth are as follows: first, the sales volume and price of the company's main coal products increased year-on-year in the reporting period due to the strong demand of coal market and rising price; Second, the company continues to strengthen cost control; Third, due to the acquisition of shares under the same control last year, the profit of the reporting period increased significantly year on year.

4Shaanxi Coal and Chemical Industry

Performance: the net profit attributable to shareholders of listed companies is expected to be 8 billion to 8.5 billion yuan in the half year of 2021; Compared with the same period last year, it increased by 3.015 billion yuan to 3.515 billion yuan, an increase of 60% to70% .

According to the 2020 annual report, the main businesses of Shaanxi coal industry are coal mining, other industries and railway transportation, accounting for 97.02%, 2.22% and 0.76% of the revenue respectively. The main reasons for the expected increase of the company's performance are as follows: first, China's economic recovery accelerated during the reporting period, the strong demand of coal market, the rise of coal prices and other factors, and the price of the company's main coal products increased year-on-year; Second, the company's high-quality coal production capacity was further released, and the production and sales volume increased steadily.

5Western Mining

Performance: it is estimated that the net profit attributable to shareholders of Listed Companies in the first half of 2021 will increase by about 1060 million yuan compared with the same period of last year, a year-on-year increase306%about。

The mining industry in Western China is mainly engaged in the mining, processing, smelting and trading of copper, lead, zinc, iron and other basic non-ferrous ls and ferrous ls. It is divided into four parts: mining, smelting, trading and finance. During the reporting period, the output of copper concentrate increased compared with the same period of last year, the market price of non-ferrous ls continued to improve, and the prices of copper concentrate and zinc concentrate increased significantly compared with the same period of last year, which was the main reason for the year-on-year increase in performance.

6Tongling Nonferrous ls Co., Ltd

Performance: the net profit attributable to the shareholders of the listed company was 1250 million yuan, an increase of 232.73% over the same period of last year

Tongling Nonferrous ls Co., Ltd. is a large-scale copper production enterprise integrating copper mining, smelting, processing and trade. Its main products include cathode copper, sulfuric acid, gold, silver, copper foil and copper strip. The increase in business performance was mainly due to the sharp rise in the prices of cathode copper, sulfuric acid and iron pellets, and the rapid rise in copper foil processing fees.

Welcome to visit Dalian Shangfeng Flotation Reagents Co., Ltd. website!

Welcome to visit Dalian Shangfeng Flotation Reagents Co., Ltd. website! Service Hotline: 0411-84667000

Service Hotline: 0411-84667000

>

>